The UK’s leading NNN REIT

Whowe are

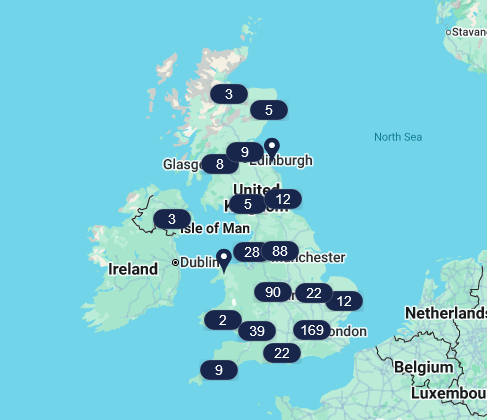

LondonMetric is a FTSE 100 real estate company that owns £7 billion of structurally supported assets. It is the UK’s leading Triple Net Lease (NNN) REIT with contracted rent of over £400 million per annum.

Our aim is to build on our position as the UK’s leading Triple Net Lease REIT. By investing in mission critical and key real estate assets that benefit from structural drivers, we will deliver reliable, repetitive and growing income over the long term.

£ 7.4 bn

Portfolio value683

Assets98 %

Occupancy£ 420 m

Contracted rent (pa)16 years

WAULT54

EmployeesOur business drivers & markets

“Our focus on the macro trends has served us well and continues to influence our capital allocation. We are a high conviction triple net income investor in structurally supported sectors benefiting from consumer tailwinds of online shopping, convenience retail, social experiences and healthcare.”

Chief Executive Officer

Our triple net

‘NNN’ lease REIT strategy

Invest

in winning sectors and assetsWe own properties that are aligned to long term structural trends and remain relevant in an ever changing world.

We focus on mission-critical and key real estate assets that have enduring occupier appeal and we constantly evolve the portfolio to ensure it remains fit for the future.

Manage

our assets efficiently and collaborativelyWe manage our assets in a disciplined, responsible and low cost way, with the lowest cost ratio in the sector.

Our collaborative approach allows us to leverage our expertise to benefit from strong relationships.

Generate

exceptional income with growthOur assets generate reliable and secure income. They are let on long leases, are single-tenanted with property expenses paid for by the tenant.

These strong income characteristics together with our high certainty of income growth through contractual and open market rent reviews underpin our progressive dividend.

Best in class team with an entrepreneurial spirit

Our people are critical to the success of the Company. Our team’s alignment to the Company’s success ensures an ownership culture and a strong conviction to make the right property and financial decisions.