- Link to Home page

- Link to Sustainability page

- Link to Environmental

Environmental

Own sustainable real estate

Through our activities we look to minimise the environmental impact of our business, maximise opportunities to improve the efficiency of our assets and improve the resilience of our assets to climate change and the impact of transitioning to a low carbon economy.

Overview

LondonMetric is committed to reducing the environmental impact of its portfolio and supporting occupiers in their transition to a low-carbon economy. Our environmental strategy targets net zero carbon for operational emissions by 2050, with clearly defined milestones.

We look to own modern, energy-efficient assets and invest in building upgrades, solar generation and environmental resilience. As of 2025, 92% of our portfolio is EPC A-C rated, and we have installed over 8MWp of solar PV.

We actively consider climate-related risks and opportunities as part of our decision-making process and align with the TCFD framework to assess the resilience of our assets to climate change.

Environmental considerations are embedded throughout our operations, ensuring our assets retain value, are efficient and fit for the future.

92 %

Portfolio EPC ‘A-C’ rating2050

Fully net zero portfolioWe are supporting the UK transition to a low carbon economy

We are targeting net zero across our portfolio by 2050. With a clear pathway of modelled interventions, we estimate reduced emissions of 71% by 2035, from a 2023 baseline of 39 kgCO₂e/m². For our directly controlled emissions, we are targeting net zero for Scope 1 and 2 by 2027.

Scope 3 emissions — primarily from occupiers’ energy use — represent most of our footprint. Reducing our occupiers’ emissions require collaboration with them, high energy data coverage and strategic asset interventions.

Our approach is science based and is aligned with CRREM and the UK Net Zero Carbon Buildings Standard. We are prioritising absolute emissions reductions and only using carbon offsets where residual emissions remain unavoidable.

Our Net Zero Pathway, published in 2025, outlines the clear actions we are taking to reduce emissions, build resilience and futureproof our assets for a low-carbon economy.

71 %

Reduction in emissions estimated by 2035 on portfolio2027

Net Zero target date for Scope 1&2 emissions

Adding value by improving our assets

We take a proactive approach to enhancing the energy performance and environmental credentials of our assets. Our focus is on delivering improvements, particularly on lease events and we work closely with occupiers to support their sustainability goals. This includes measures such as LED lighting retrofits, heating system electrification, smart metering and on-site solar installations.

Our activity has helped to increased our portfolio EPC A-C rating to 92% and EPC A-B to 58%. Across our portfolio, we have 8MWp of solar PV capacity installed to date, with further installations in progress. All refurbishment and development activity is reviewed against our Net Zero Pathway to ensure alignment with our decarbonisation strategy and to address regulatory and transition risks.

By integrating ESG across all of our activities, we are improving asset resilience, reducing carbon emissions and delivering long-term value for our stakeholders.

8 MWp

Solar installed to dateEPC ‘B’

Minimum requirement for refurbishment projectsHelping our occupiers meet their sustainability goals

Most of the carbon emissions across our portfolio are outside our direct control which makes occupier collaboration central to delivering environmental improvements across our portfolio. We engage proactively with occupiers to support their decarbonisation goals and explore opportunities to reduce operational emissions.

Our approach includes green lease clauses, incentivising energy efficiency upgrades and the installation of renewable energy, as well as occupier surveys to understand our occupiers’ needs and sustainability considerations. We have implemented an energy data platform to more accurate track whole-building energy use and improve transparency around Scope 3 emissions.

80 %+

Occupier data collection94 %

Occupiers surveyed in 2025Case studies

ESG - Explore our work

Case study

Solar at Huntingdon

Large scale solar PV system covering the majority of the warehouse’s roof

1.9 MWp

Solar PV added500 tCO2e

Saved emissionsA

EPC ratingAt our 300,000 sq ft logistics warehouse let to AM Fresh, 1.9MWp of solar was installed in 2024. LondonMetric had previously funded the development of the warehouse in 2022 and the PV system is expected to provide AM Fresh with c.28% of its annual energy needs and save c.500 tonnes of CO2 emissions p.a.

Case study

Bicester refurbishment

Comprehensively refurbished to ‘as new’ condition

68,000 sq ft

RefurbishedA+

EPC rating160 kWp

Solar PV addedAt our Bicester logistics asset, the warehouse was comprehensively refurbished in 2024, with the roof replaced, roof lights added and solar PV installed. We also upgraded the internal lighting and systems, replaced gas with a 47kWp electrical heating system and installed three EV charging points. The works have increased the EPC rating to ‘A+’ from ‘C’ and the 160kWp solar PV system is expected to save 28tCO2e p.a.

The refurbishment also incorporated biodiversity initiatives, such as a bee house, an eco-friendly bug hotel and new wild flower planting.

Case study

Eastleigh refurbishment

Refurbished to a high standard with significant rental uplift

31,000 sq ft

RefurbishedA

EPC rating63 kWp

Solar PV addedAt our Eastleigh logistics asset, we undertook roof and lighting upgrades, installed solar PV and two EV charging points and replaced gas with a 32kWp electrical heating and cooling system. The improvements were undertaken in 2024 and increased the asset’s EPC rating to ‘A’ from ‘C’ and the 63kWp solar PV system is expected to meet c.43% of the occupier’s energy requirement and save 12tCO2e p.a.

The warehouse has been let at a rent 30% higher than was paid by the previous occupier, and we have also seen the occupier at an adjacent unit implement similar improvements as a result of our actions.

Case study

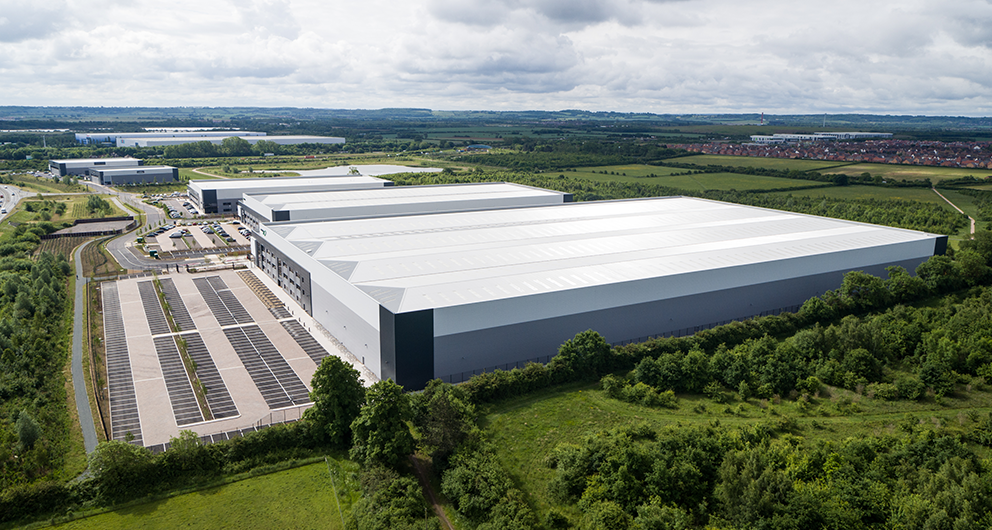

Logistics development at Bedford

A high-quality sustainable logistics park, let to strong and growing businesses

£ 70 m

Build cost715 k sq ft

Across five assets£ 6 m pa

IncomeBedford Link is LondonMetric’s flagship logistics asset which it developed in three phases and completed in 2024 for a total cost of c.£70 million reflecting a yield on cost of c7.5%.

The asset is very well located in Bedford next to the A421 and comprises five warehouses across 715,000 sq ft and is let to Movianto, Carlton Packaging, Leidos, Larson-Juhl and Workstories with an average lease length of over 15 years. The properties are all BREEAM Very Good or Excellent certified.

“We have worked over a number of years to deliver an exceptional logistics park of high quality buildings which are let to strong occupiers and are delivering strong rental growth. Our engagement with stakeholders such as Bedford Council, contractors, local residents and businesses has contributed to the success of this development.”

Nick Heath,

Head of Projects